Filed under: Sustainability in France | Tags: Banks, Carbon Footprint, Finance, Vigeo, WWF

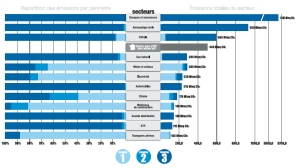

The banking and insurance sector creates overall the largest carbon footprint : 3680 MTons CO2, compared to 925 Mtons CO2 of the 2nd largest sector, those of civil airplanes.

These are results of a recent published study of 10 French business sectors by the French auditor and consultancy Vigeo and the WWF (1). Likely to be representative for other Western countries.

Green house emissions in 10 industry sector according to analyses ofVigeo and WWF.

You may be surprised. How could banks only using ‘just some electricity and paper’ count for the largest green house effects ?

Using Life Cycle Analyses principles, the carbon footprint of a compay (or a sector) is based on 3 perimeters : (1) The companies production process (production phase impact) (2) The production process of used materials (suppliers impact) (3) The effects of the products of the companies (product use impact)

The direct created carbon footprint (lever 1) may not be very high, nor does the production of energy to warm the buildings (lever 2). However, by financing other industry projects (lever 3), like energy, property development, transport, the overall impact of the banking and insurance sector ends up to be the most significant of all sectors.

Banks carry therefore a high responsiblity to pull the right levers. They should not reduce their own and direct impact by reducing energy, water, paper use. If they make sustainability part of their company strategy, they notably carry a responsibility to choose sustainable over green house gas emitting technologies.

Investments in renewable energy – a banks choice

And you, what can you do ? Ask your bank how it makes its finance sustainable choices ! Does the bank set requirements on maximum green house emissions for property development ? Do they preveal clean and sustainable technologies ? Do they favour renewable energy projects ? In France, Banque Populaire, now BPCE, is seen as a good exemple. See also the BPCE ‘Best Practices’.

For those who do not believe in the power of customer pressure : Just remember the recent collapse of the Dutch DSB bank, a small bank that offered loans and mortages. The bank went bankrupt this year, after a group of dissatisfied customers asked people to withdraw all their savings – which they did.

Source : ‘Entreprises et changement climatique’, nov 2009, Vigeo et WWF, http://www.vigeo.com/csr-rating-agency/images/PDF/Publications/etude-climat-Vigeo-WWF.pdf

1 Comment so far

Leave a comment

[…] is well aware of the responsibilities of banks being able to build or break sustainable innovation (see earlier post) Rabobank wants to play a role in food and agri chains worldwide and encourage […]

Pingback by Rabobank, an exemplairy bank « Sustainable Innovation December 22, 2009 @ 12:41 am